Welcome to the financial fantasy league where signing bonuses have more zeros than most people’s lifetime earnings. Major League Baseball doesn’t just change these players’ positions in the standings—it rockets them into a financial stratosphere that would give most accountants vertigo. One day they’re riding minor league buses; the next, they’re contemplating which mansion matches their Ferrari.

The financial curveballs thrown at newly-minted millionaires often result in spending decisions that would make Warren Buffett need a stress ball. Some players navigate this wealth with the same precision they bring to hitting a 98-mph fastball, while others swing wildly at every investment opportunity that crosses the plate. The financial box scores of baseball’s biggest spenders reveal as much about human nature as they do about wealth management. The following scorecard highlights the most extravagant at-bats in baseball’s financial game.

8. Dee Gordon’s Full-Page Thank You to Ichiro

In a sport where players typically express gratitude through canned press conferences and generic tweets, Dee Gordon went old-school with a gesture straight out of baseball’s golden era. The speedy second baseman dropped serious cash on a full-page Seattle Times ad in March 2019, celebrating Ichiro Suzuki’s retirement with the printed equivalent of a standing ovation.

Gordon’s financial splurge revealed something statisticians can’t quantify—the profound impact of mentorship in a game built on failure. Having first encountered Ichiro as a wide-eyed kid in Houston back in 2004, Gordon later became his teammate in both Miami and Seattle. When news broke that he’d join the Mariners, Gordon reportedly did backflips that would make Ozzie Smith nod in approval. His newspaper tribute stands as baseball’s version of spending a first big paycheck on the person who helped earn it.

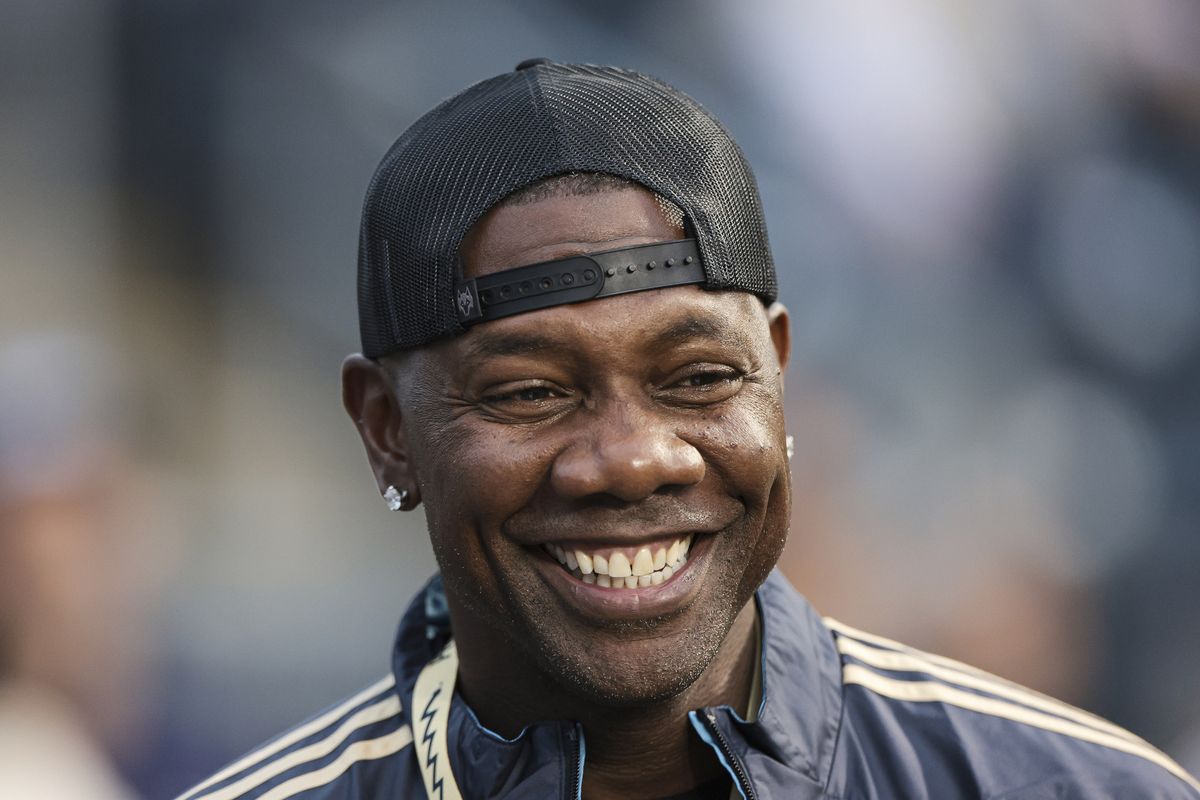

7. Rickey Henderson’s Wall-Mounted Money

The greatest leadoff hitter in history, stolen base king, and third-person enthusiast Rickey Henderson once took a $1 million signing bonus from the Oakland Athletics and, instead of depositing it, treated it like a Cooperstown artifact—a story verified by multiple reputable sources.

The Man of Steal hung his million-dollar paper on the wall like a motivational poster, apparently unaware that money framed earns no interest. Financial analysts estimate Henderson sacrificed roughly $70,000 in potential earnings during his check’s stint as home decor—a calculation that experts consider likely accurate, though specific figures may vary depending on interest rates at the time. After his financial advisors explained that this particular collectible was hemorrhaging value faster than a junk bond, Henderson finally cashed it. The story perfectly captures how even the savviest baserunners can miss financial signals.

6. Randy Johnson’s Arizona Power House

The Big Unit needed a big property, and Paradise Valley delivered a homerun. Randy Johnson—all 6’9″ of him—dropped $2.7 million on his Arizona estate in 1999, the same year he struck out 364 batters and won his second Cy Young Award. The timing proved as precise as his legendary slider.

Johnson’s five-acre compound reflected his larger-than-life presence: guest house for visiting teammates, tennis court for cross-training, home theater large enough for a dozen baseball scouts, and—most tellingly—a bath house featuring a wood-burning pizza oven. (Who says lefties aren’t quirky?) When Johnson sold the property in 2016 for $7.3 million, he recorded a capital gain that matched his career ERA+ of 135—well above average. Unlike many athlete investments that depreciate faster than a 38-year-old knuckleball specialist, Johnson’s real estate play demonstrated the same patience he showed waiting out batters.

5. Ryan Howard’s Tampa Mega-Mansion

Ryan Howard approached home construction with the same swing-for-the-fences mentality that produced 58 homers in his MVP season. The Phillies slugger built a Tampa Bay waterfront palace measuring an absurd 46,000 square feet—roughly the size of the visitor’s bullpen at Citizens Bank Park.

Howard’s architectural stat line included features that made most luxury homes look like minor league facilities: panoramic ocean views, an all-stone facade that probably required its own quarry, and—in a move that would make any 10-year-old with a LEGO obsession jealous—a lazy river flowing throughout the property and directly into an indoor bowling alley. His master closet alone could have housed several utility infielders comfortably. Howard’s power numbers declined more predictably than his real estate value; he sold the property in 2019 for $16.6 million after initially swinging for $18 million. Like many pull hitters facing a defensive shift, Howard’s hyper-specific design preferences narrowed the field of potential buyers.

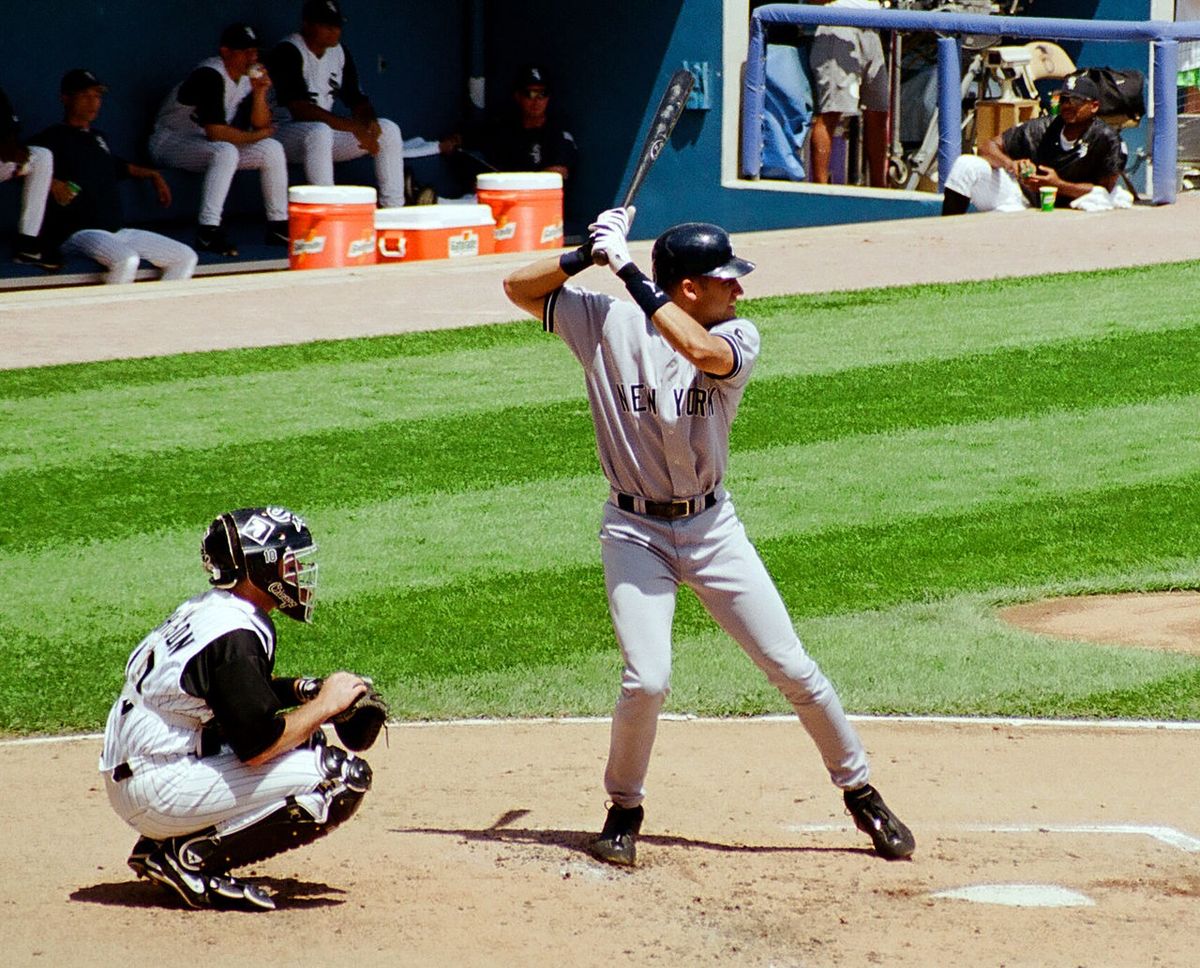

4. Derek Jeter’s Florida Fielder’s Choice

Derek Jeter approached real estate with the same calculated precision he used to spray opposite-field hits for two decades. The Captain secured prime waterfront acreage in Coral Gables following retirement, demonstrating his understanding that—unlike middle infielders—waterfront property doesn’t lose value with age.

The shortstop legend dropped $16.6 million on two acres in a gated community where security rivals Monument Park. The property includes space for dual yacht docks—convenient for a man accustomed to navigating the turbulent waters of New York media. Architect Caesar Molina designed a 20,000-square-foot Mediterranean villa featuring the kind of unobstructed water views Jeter once enjoyed from his position at Yankee Stadium. Though representing nearly 8% of his estimated $200 million career earnings, Jeter’s investment shows the financial discipline that baseball insiders always admired. While other players chase flashy returns, Jeter opted for the real estate equivalent of hitting behind runners—a consistent, productive strategy that wins championships.

3. Albert Pujols’ Restaurant Strikeout

Albert Pujols dominated opposing pitchers for years, but his foray into the restaurant business proved he couldn’t hit everything out of the park. The future Hall of Famer opened Pujols’ 5 Westport Grill in Missouri while still crushing National League pitching for the Cardinals, serving upscale American fare to fans hungry for both food and proximity to greatness.

The restaurant’s most memorable feature wasn’t on the menu but rather guarding the entrance: a 10-foot, 100-pound statue of Pujols himself that cost a cool $30,000—approximately what he earned every two innings during his prime. The establishment operated from 2006 to 2013, but folded faster than a weak infield pop-up after Pujols departed for Anaheim. The restaurant’s trajectory mirrors many athlete ventures: initial excitement followed by declining interest once the star leaves town. Like the defensive shift that eventually neutralized Pujols’ pull-hitting tendency, market realities eventually caught up with his dining establishment.

2. A-Rod’s Timberwolves Power Play

Alex Rodriguez, unable to purchase the Mets despite 696 career homers on his baseball résumé, executed a $1.5 billion backdoor slider into sports ownership by acquiring the Minnesota Timberwolves in 2021. A-Rod partnered with tech mogul Marc Lore on the deal, demonstrating the same strategic teamwork that characterized his on-field partnership with Derek Jeter—before their notorious fallout.

The former Yankee slugger joined the exclusive club of athlete-owners that includes Michael Jordan and Magic Johnson, though in a different sport than his playing career. This crossover move resembles Rodriguez’s transition from shortstop to third base—an adaptation that maximizes value while acknowledging market realities. Sports franchise valuations have climbed more consistently than Rodriguez’s postseason batting average, making team ownership potentially more lucrative than traditional investment vehicles. By purchasing the Timberwolves, Rodriguez secured a scarce asset in a market with artificial supply constraints—not unlike the limited number of starting positions in Major League Baseball.

1. Miguel Cabrera’s Costly Extra-Innings Affair

Miguel Cabrera has always known how to produce runs—both on the diamond and, as it turns out, in his personal life. The Triple Crown winner secretly maintained a second family, doubling his personal roster with two children from a relationship with a Florida flower shop owner while married to his wife.

The Venezuelan slugger funded a lifestyle that would make some teammates envious: European vacations, a Range Rover, and a million-dollar home—all while maintaining his primary family. In 2016, when this parallel universe collapsed faster than the Tigers’ playoff hopes typically do, Cabrera’s extramarital scorecard resulted in a $5 million lawsuit. The courts slapped him with $14,000 monthly payments per child, plus expenses covering everything from mortgages to private tutors. Unlike baseball, where luxury tax penalties eventually end, Cabrera’s financial obligations will continue long after his playing days conclude. His off-field decisions have proven more costly than any slump or injury during his otherwise illustrious career.