Baseball contracts are like first dates with millionaires—exciting, full of promise, and carrying just enough risk to keep things interesting. Beyond the eye-popping figures lies a fascinating ecosystem where general managers gamble on human potential while fans hold their collective breath.

Remember when your friend bought that vintage Mustang that looked gorgeous but spent more time in the shop than on the road? That’s the Alex Rodriguez Rangers deal. Or that time you discovered an obscure indie band before they hit mainstream? That’s the Diamondbacks signing Randy Johnson. Let’s explore baseball’s best bargains and most regrettable splurges, where every dollar tells a story about baseball’s evolving economy.

15. Randy Johnson (1999, Diamondbacks)

The Big Unit’s deal with Arizona rocked the baseball world harder than his fastball rattled batters. At $110.5 million over four years (inflation-adjusted), the Diamondbacks didn’t just buy a pitcher—they purchased a dynasty’s cornerstone. Johnson delivered a mind-boggling 38 WAR at $2.91 million per WAR, the baseball equivalent of finding a Picasso at a garage sale.

His strikeout totals—334, 347, 364, and 372—read like a hitter’s nightmare diary. Four straight Cy Youngs, a World Series ring, and a Triple Crown later, the Diamondbacks’ gamble on a 35-year-old “aging” pitcher seems less like calculated risk and more like baseball clairvoyance. Johnson didn’t just meet expectations; he thundered past them like one of his signature sliders defying physics.

14. Barry Bonds (1993, Giants)

The Giants didn’t just sign Barry Bonds in ’93—they pulled off baseball’s greatest heist without wearing masks. For $159.9 million over six years (inflation-adjusted), San Francisco received a ridiculous 49.6 WAR at $3.2 million per WAR. In baseball economics, that’s similar to buying Amazon stock in 1997.

Bonds never took days off from excellence. His worst season still produced 6.2 WAR—better than most players’ career years. His lowest OPS? A casual 1.009. From 1989-1998, Bonds amassed an absurd 84.3 WAR while transforming the Giants from afterthoughts to contenders. The baseball intelligentsia questioned the contract’s size at the time, but history has a funny way of sorting these things out. The Giants essentially bought a Ferrari at Toyota prices.

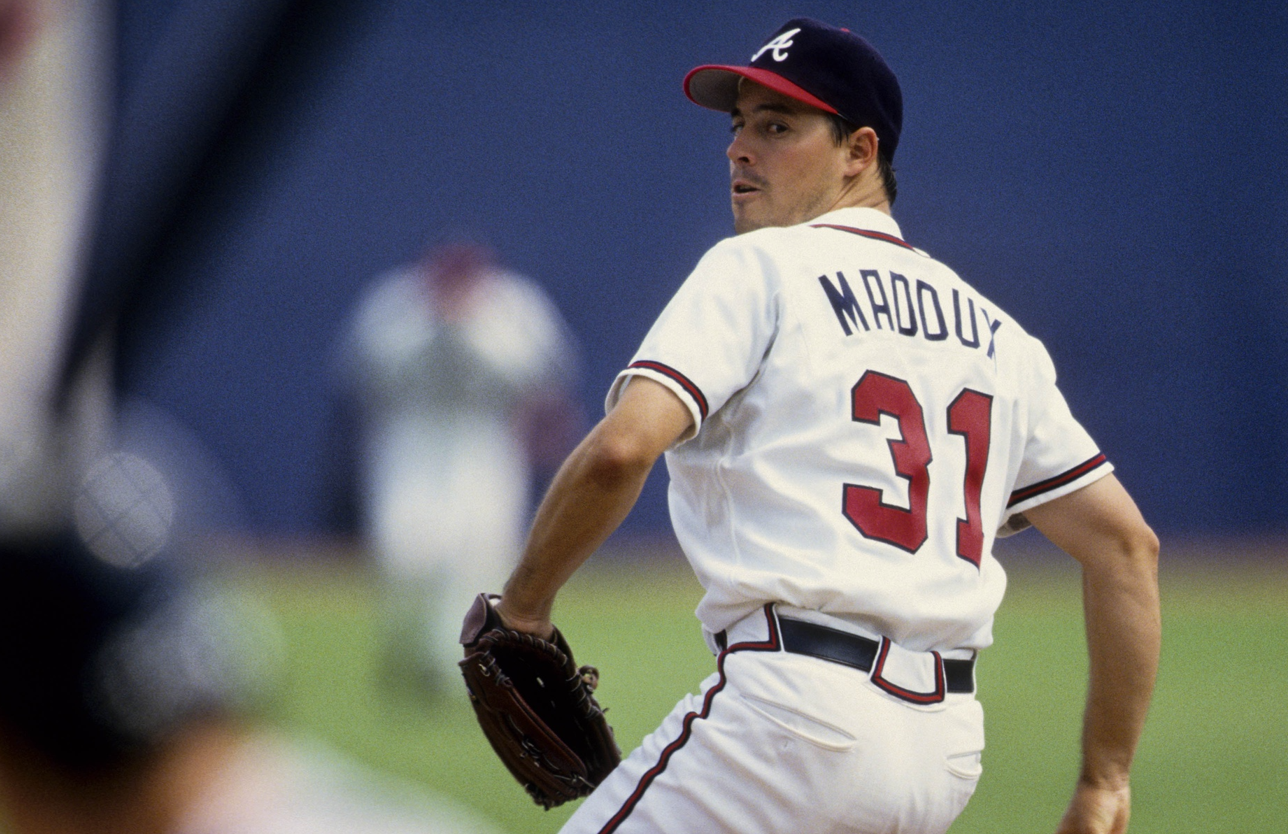

13. Greg Maddux (1993, Braves)

The Professor’s signing with Atlanta remains baseball’s greatest example of brains beating brawn. At $126.3 million over five years (inflation-adjusted), Maddux delivered 39 WAR at $3.24 million per WAR—numbers that make modern GMs sweat with envy. The Yankees thought they had him locked up until Atlanta swooped in at the last moment, altering baseball’s power structure for a decade.

Three straight ERA titles and Cy Youngs barely tell the story. Maddux painted corners with surgical precision while other pitchers were still throwing with sledgehammers. His contract sparked the Braves’ dynasty and demonstrated why sometimes the quietest signings make the loudest impacts. Any fan who watched Maddux carve up lineups with 88-mph fastballs understands why velocity will never trump artistry.

12. Adrian Beltre (2011, Rangers)

Some ballplayers transcend statistics, and Beltre’s 2011 Rangers deal showcases the beautiful mystery of baseball evaluation. Texas invested $117.9 million over six years (inflation-adjusted) and harvested a bountiful 35.8 WAR at $3.29 million per WAR. The secret sauce? Texas bet on Beltre’s skills rather than his Seattle numbers—a masterclass in scouting over spreadsheets.

Beltre hit .308 with 167 homers while playing third base defense that made routine plays look artistic and impossible plays look routine. He received MVP votes every season without ever cracking the top 25 salary list—proof that the market sometimes misses greatness hiding in plain sight. Jon Daniels and the Rangers front office spotted a market inefficiency and rode it to two pennants, reminding us that sometimes baseball’s best values aren’t the ones making headlines.

11. Pedro Martinez (1998, Red Sox)

Boston’s acquisition of Pedro Martinez wasn’t just a signing—it was a seismic event in franchise history. At $152.5 million over five years (inflation-adjusted), the Red Sox received 41.1 WAR at $3.7 million per WAR. But reducing Pedro to numbers feels like describing the Sistine Chapel as “paint on a ceiling.”

His 1999-2000 peak stands as perhaps the most dominant pitching exhibition baseball has ever witnessed. The 2.27 ERA and 212 ERA+ in the heart of the steroid era? Absurd. The 87-24 record? Nearly fictional. Pedro didn’t just change games; he altered the psychological landscape of Fenway Park, transforming a pessimistic fanbase into believers. His performances weren’t just starts—they were events, happenings, must-see TV that justified every penny of his then-controversial contract.

10. Scott Rolen (2003, Cardinals)

Rolen’s eight-year, $136.5 million (inflation-adjusted) Cardinal contract reveals how narrative often overshadows numbers in baseball memory. Providing 35.9 WAR at $3.8 million per WAR, Rolen delivered exceptional value that somehow still flies under the radar in contract discussions. His 2004 season should be required study for aspiring third basemen.

What the metrics can’t capture is Rolen’s impact on clubhouse culture and defensive positioning. His glove work made Cardinals pitchers better by statistical osmosis. A shoulder injury from a 2005 collision with Hee-Seop Choi limited his ceiling, but his contributions to the 2006 championship validated St. Louis’ investment. That’s the funny thing about baseball contracts—sometimes the less celebrated ones age the best. Rolen’s eventual Hall of Fame plaque confirms what Cardinals fans knew all along.

9. Ivan Rodriguez (1998, Rangers)

The Rangers handed Pudge Rodriguez $100.75 million (inflation-adjusted) over five years when defense still lived in baseball’s analytical shadows. The return? A reasonable 25.7 WAR at $3.9 million per WAR, two stellar 6.4 WAR campaigns, and an MVP trophy that validated Texas’s vision.

Numbers tell only part of Rodriguez’s story. That 53% caught stealing rate fundamentally changed opposing game plans. Managers simply stopped running—300 attempts across 4833 innings—effectively eliminating baserunning as an opponent’s offensive strategy. Rodriguez transformed the catching position from defensive necessity to offensive weapon during an era when backstops were still expected to be light-hitting field generals. Twenty years before framing metrics became front office buzzwords, Texas recognized greatness that couldn’t fit in spreadsheets.

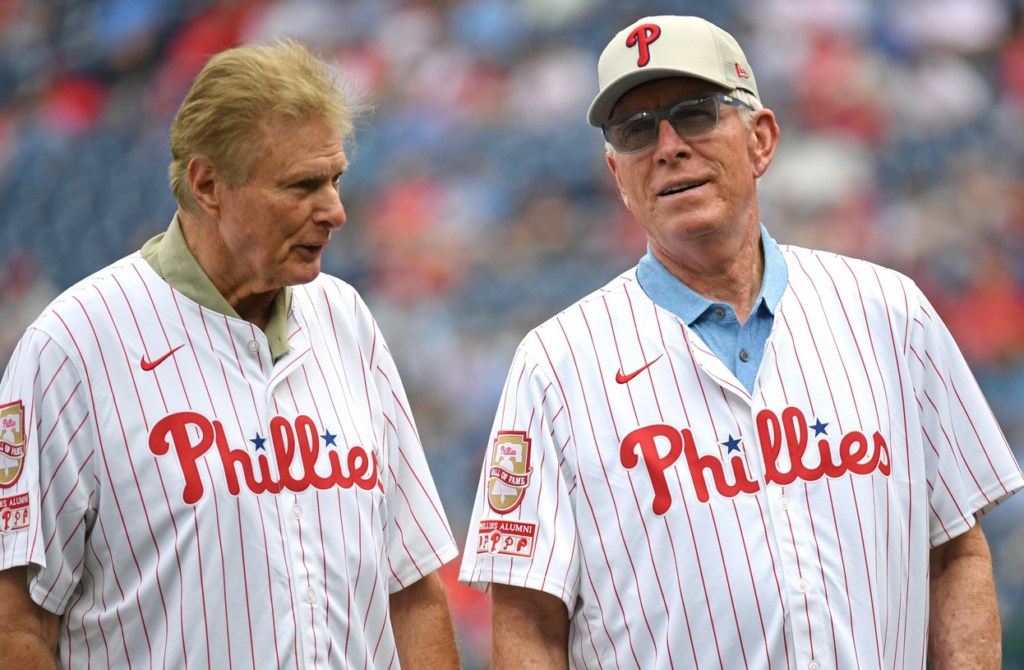

8. Mike Schmidt (1982, Phillies)

Today’s baseball fans might not realize that Schmidt’s 1982 deal—$152.8 million over six years in modern money—was as revolutionary as the third baseman himself. His 38.5 WAR at $3.97 million per WAR represents exceptional value, but the real story is how dramatically Schmidt changed third base expectations forever.

Schmidt’s contract paid for everything: four Gold Gloves, consistent MVP-level performance (top 10 four times, winning in ’86), and leadership that propelled Philadelphia to the 1983 World Series. He managed this production while playing half his games in Veterans Stadium, a notoriously difficult hitter’s park that suppressed his numbers. In today’s game, where teams analyze launch angles and exit velocities, it’s worth remembering that Schmidt mastered these concepts decades before they had names.

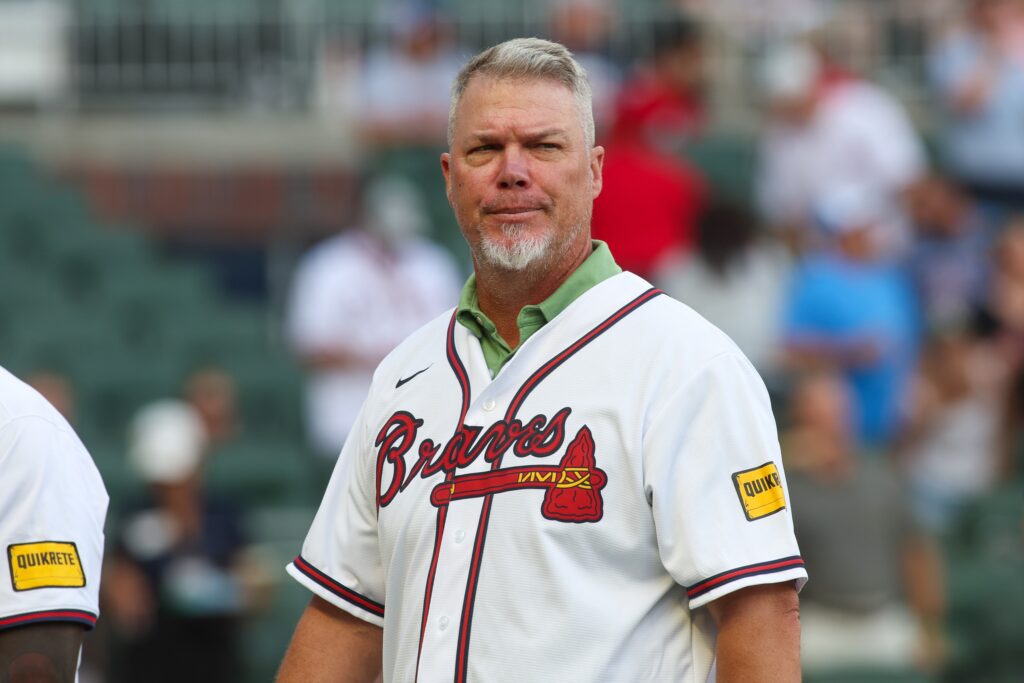

7. Chipper Jones (2001, Braves)

Chipper’s 2001 extension—$183.3 million over eight years in today’s dollars—wasn’t just a contract; it was Atlanta’s declaration that some players transcend spreadsheets. Jones delivered 42.7 WAR at $4.3 million per WAR while batting a casual .317 with 219 homers. That’s production you can set your watch to.

The Braves built a philosophy around consistency that modern analytics often undervalue. Jones produced four-plus WAR in seven different seasons, helping Atlanta make five playoff appearances. In an era where players bounce between teams like pinballs, Jones offered certainty—fans bought jerseys knowing they wouldn’t become vintage items by next season. Sometimes the best contracts aren’t about dollars-per-WAR but the intangible value of a player who embodies an organization’s identity.

6. Barry Bonds (2002, Giants)

Bonds’ second appearance on this list—a $162.3 million extension over five years (inflation-adjusted)—forced baseball to confront uncomfortable questions about value versus values. The numbers: 36.2 WAR at $4.48 million per WAR, three straight MVPs, and a .575 on-base percentage that broke baseball’s statistical systems. His 2004 season featured 232 walks with 120 intentional—numbers from a video game with cheat codes activated.

A knee injury erased most of 2005, but the Giants still reaped massive rewards both financially and competitively. San Francisco sold out games when Bonds batted, not when the bullpen door swung open. His extension represents the complex calculus teams must perform when exceptional talent comes with exceptional baggage. The Giants bet that performance would trump controversy—a wager that paid dividends on the field but whose full cost remains difficult to calculate.

5. Max Scherzer (2015, Nationals)

The Nationals caught flak for “overpaying” Scherzer with a $195.6 million deal (inflation-adjusted) spanning seven years. Baseball’s smartest critics looked at his age (30) and workload, predicting imminent decline. Spoiler alert: those pundits might want to delete some tweets.

Scherzer returned 41.5 WAR at $4.7 million per WAR, bagged consecutive Cy Youngs (2016-17), tossed two no-hitters, tied the single-game strikeout record (20), and capped it with a champagne shower after the 2019 World Series. His heterochromatic eyes seemed to see the strike zone in higher definition than everyone else. Scherzer’s contract proves an important axiom about baseball investments: sometimes paying premium prices for premium talent is actually the safest bet of all, especially when that talent brings championship-level intensity every fifth day.

4. Justin Verlander (2015, Tigers)

Verlander’s 2015 Tigers extension tells the fascinating story of how contracts evolve across organizations. Detroit invested $144 million (inflation-adjusted) over five years, receiving 30.3 WAR at $4.75 million per WAR—solid value that became spectacular after a landscape-changing trade.

The first act featured Verlander’s resurgence in Detroit, finishing second in 2016 Cy Young voting after many had written his obituary. Act two saw Houston inherit the contract and reap championships and Cy Youngs as Verlander enjoyed a late-career renaissance that defied aging curves. His story highlights how contracts can’t be evaluated in isolation—team context, coaching staffs, and organizational philosophy can transform the same deal from burden to bargain. Verlander’s journey reminds us that even the most sophisticated projection systems can’t account for a competitor’s heart.

3. Adrian Beltre (2005, Mariners)

Before becoming a Rangers legend, Beltre’s Seattle chapter serves as a cautionary tale about contract context. The Mariners committed $101.2 million (inflation-adjusted) over five years after Beltre’s monster 2004 with the Dodgers. The result? A respectable but underwhelming 21.3 WAR at $4.75 million per WAR and zero playoff appearances.

Seattle’s Safeco Field suppressed Beltre’s offensive numbers like a weighted blanket on a home run swing. The spacious dimensions transformed potential homers into warning-track flyouts, masking the excellence that would later flourish in Texas. The same player with identical skills provided radically different value in different environments—a crucial lesson for front offices eyeing free agents. Sometimes a player’s underperformance has more to do with zip codes than effort or ability.

2. Miguel Tejada (2004, Orioles)

The Orioles dropped $114 million (inflation-adjusted) over six years to make Tejada their franchise cornerstone. His 23.9 WAR at $4.78 million per WAR technically qualifies as fair value—about what you’d expect for a premium shortstop. His explosive first season in Baltimore (7.4 WAR) had fans dreaming big.

Those dreams crashed against the hard reality of roster construction. Not once during Tejada’s Baltimore tenure did the Orioles post a winning record. His contract exemplifies the “one star isn’t enough” principle that haunts rebuilding franchises who splash cash before establishing a foundation. Tejada performed admirably in baseball’s toughest division, but the Orioles’ failure to surround him with complementary talent turned potential breakthrough seasons into footnotes. Even Babe Ruth couldn’t win games from the on-deck circle.

1. Alex Rodriguez (2001, Rangers)

A-Rod’s infamous $252 million Rangers deal ($287 million inflation-adjusted) stands as baseball’s ultimate “be careful what you wish for” parable. Rodriguez delivered extraordinary performance—56.4 WAR at $5.1 million per WAR over seven years—while Texas spiraled into competitive irrelevance. His salary devoured 25% of the team’s payroll, leaving mere scraps for pitching help.

Rodriguez hit .305 with 240 homers as a Ranger, winning an MVP and three Silver Sluggers. He literally couldn’t have done more individually. Yet the Rangers finished dead last for three straight seasons, proving the baseball equivalent of bringing a Ferrari to a demolition derby. The deal’s legacy isn’t about Rodriguez’s performance but about roster balance and opportunity cost. Texas eventually escaped the contract by trading Rodriguez to the Yankees, where he would finally secure the championship that talent like his deserves.